Funds Administration tipsSaving moneyHandling bills and expensesShoppingFinancial healthSavings intention calculatorNet value calculator

While a loan-to-benefit ratio steps the quantity borrowed towards a household relative to the worth of a dwelling, combined LTV steps the whole volume borrowed—throughout several loans—in opposition to the value of the house.

As you’ve now viewed, Every single loan type differs, and what functions for just one particular person might not do the job for an additional. Consider the loan’s prerequisites carefully and opt for what best suits your scenario.

The payment we obtain from advertisers won't impact the recommendations or suggestions our editorial staff offers within our articles or otherwise effects any in the editorial written content on Forbes Advisor. Though we work hard to supply precise and updated info that we predict you will see suitable, Forbes Advisor won't and can't ensure that any data presented is entire and makes no representations or warranties in relationship thereto, nor to the precision or applicability thereof. Here's an index of our partners who supply items that We have now affiliate links for.

Moving to a fresh region: In accordance with one study, as numerous as forty% of retirees are venturing out of their dwelling state seeking superior weather, recreation, favorable taxes, together with other Gains

Once accepted by a lender, your funds are deposited straight into your account when the following enterprise day. We've more info been listed here for yourself

Although it is not a different loan form, lenders often simply call this an asset depletion loan or asset-primarily based loan. Borrowers should rely revenue from other resources whenever they use assets that can help them qualify.

A reverse property finance loan, also referred to as a home fairness conversion mortgage loan (HECM), is the commonest home finance loan taken out by seniors: Backed via the FHA, It lets homeowners 62 and more mature to borrow from their property's worth.

Preferably, you shouldn't Possess a mortgage loan in retirement. It is because significant month to month mortgage loan payments are more difficult to address from the absence of steady, reliable profits.

Don't just can home loan preapproval appropriate-dimension your expectations when purchasing a home—along with a lender—it’s an excellent way to indicate sellers you’re significant when it’s time for making an offer.

Can a senior on Social Safety get a home loan which has a minimal credit history rating? Acquiring a home loan by using a small credit score is tough although not difficult. Some lenders specialise in providing mortgages to folks with very low credit scores.

If the credit score rating is good enough, take into account refinancing for just a reduced desire charge. Shifting the personal debt to a more economical lender would unlock some of that further desire cash for making a dent within the principal as a substitute.

VA loans are governing administration-backed home loans which have been built especially for memes of your U.S. military services and veterans. Employing VA loan programs, suitable borrowers can finance as many as a hundred% of a home’s value.

In case you assume to have a limited cash flow, even so, and It might be difficult to sustain that has a new home finance loan, spending off your existing loan and keeping set can be the smartest shift.

Mason Gamble Then & Now!

Mason Gamble Then & Now! Brandy Then & Now!

Brandy Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! David Faustino Then & Now!

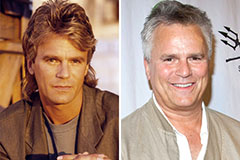

David Faustino Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!